How Foreigners Can Invest in Real Estate in Bali

Brief Summary

Foreigners can legally invest in real estate in Bali but cannot directly own land. Investments are possible through specific legal rights (HGB, Leasehold) or corporate structures. The key to success is the right legal model, location choice, and realistic income calculations. Mistakes most often arise from nominal ownership, incorrect documentation, or inflated expectations.

More Details:

1. Can a Foreigner Buy Real Estate in Bali?

Direct land ownership (Freehold / Hak Milik) in Indonesia is permitted only for citizens of the country. However, foreigners can invest in and own real estate properties through other legal mechanisms allowed by law.

In practice, two basic types of rights and one organizational structure are used:

- building rights - Building Rights (HGB),

- long-term lease - Long-Term Lease (Leasehold),

- corporate structure (PT PMA), through which HGB or Leasehold can be registered.

Each model carries different risks, durations, and investment logic.

HGB (Hak Guna Bangunan - Building Rights)

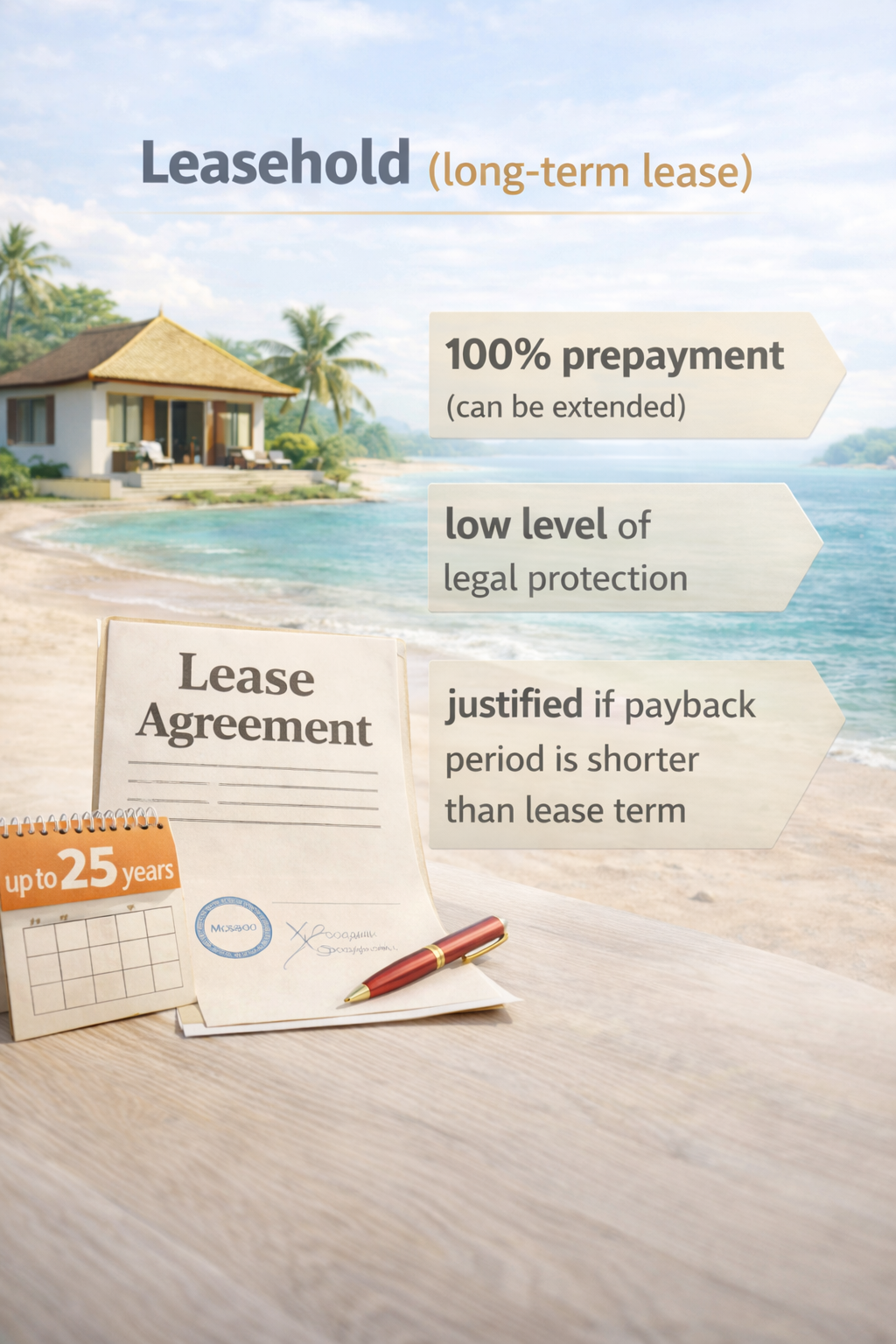

Leasehold (Long-Term Lease - long-term lease)

The right to build and own a building for a specified period.

Key features:

Key features:

- term: up to 30 years with the possibility of extension for another 20 years and a subsequent extension for another 30 years (total up to 80 years),

- can be registered to a company (PT PMA),

- used in commercial investment projects,

- provides a high level of legal protection when properly structured.

HGB is the most common model for investment villas and complexes.

Fixed-term land lease agreement.

Features:

Features:

- term usually 25–30 years + option to extend,

- lower entry threshold,

- higher risks with improperly drafted contracts,

- property value decreases as the lease term expires.

Leasehold may be justified if:

- the entry price is significantly below market,

- the contract is properly drafted,

- the investor understands the exit timeframe from the project.

2. Main Forms of Investment

PT PMA (Foreign Investment Company)

Foreigners can own real estate through a legal entity registered in Indonesia.

Used when:

Used when:

- the project is commercial,

- rental is planned,

- the property is used for business purposes,

- HGB or other commercial rights are required.

What You Need to Know:

3. Main Risks for Foreign Investors

Most Common Mistakes:

- Using a nominee owner (an Indonesian citizen) — an outdated and legally risky scheme, which is practically not used in professional projects today due to the high likelihood of losing control over the asset.

- Lack of thorough due diligence on land documents.

- Misunderstanding zoning and permitted land use.

- Purchasing a property without a clear income strategy.

- Overestimated ROI expectations without accounting for expenses.

Most problems arise not from the laws themselves, but from ignoring them.

4. What a Safe Investment Scheme Looks Like

A proper model includes:

Investing in completed or nearly completed projects reduces risks related to construction and permits.

- legal due diligence of the land,

- the correct form of title (HGB / Leasehold),

- permitted zoning for lease or development,

- a clear income model,

- transparent property management.

Investing in completed or nearly completed projects reduces risks related to construction and permits.

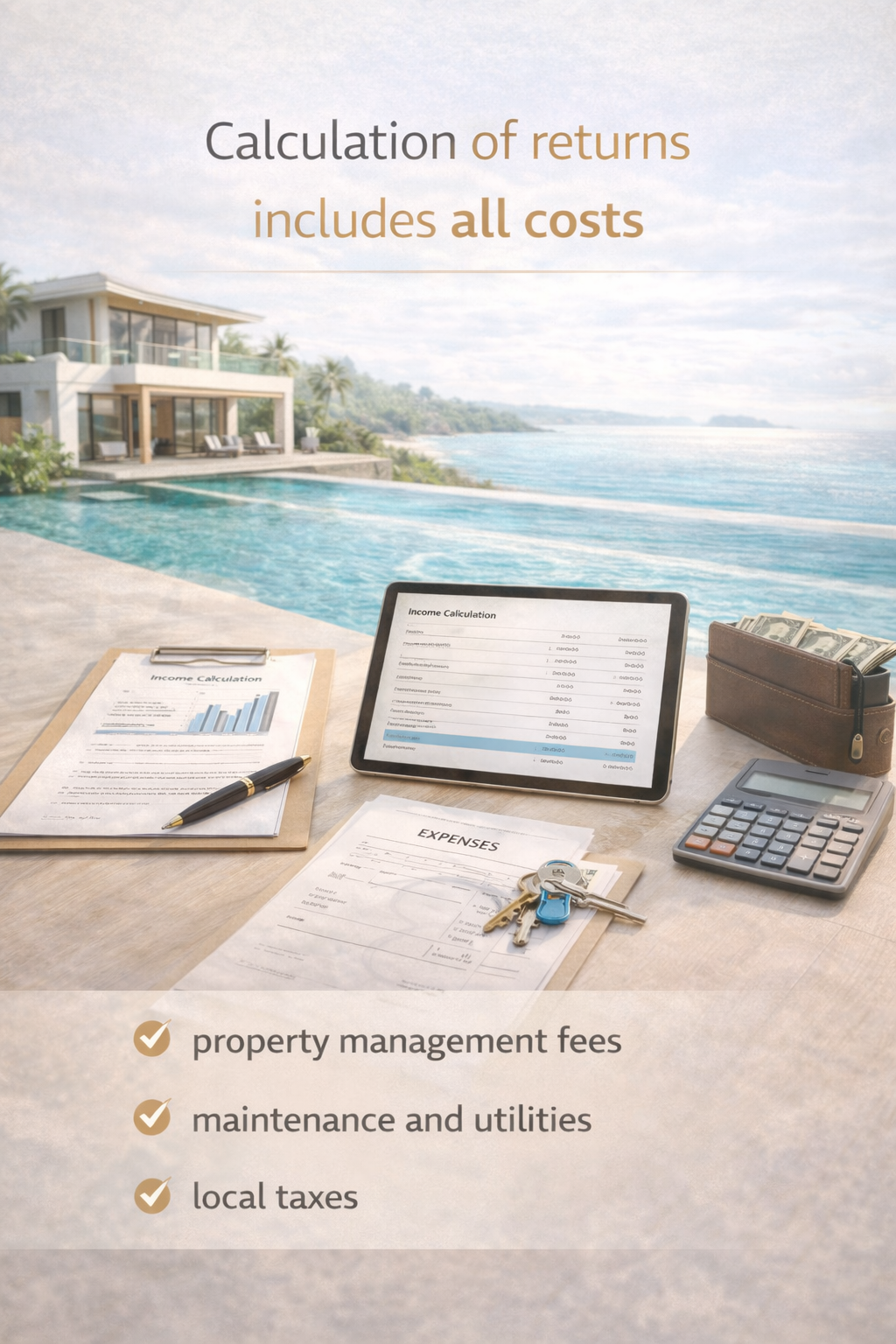

5. When Are Real Estate Investments in Bali Justified?

An investment makes sense if:

the property is located in a touristically and legally stable area

the ownership type aligns with the investor’s goals

the profitability calculation includes all expenses

there is a clear management and exit strategy

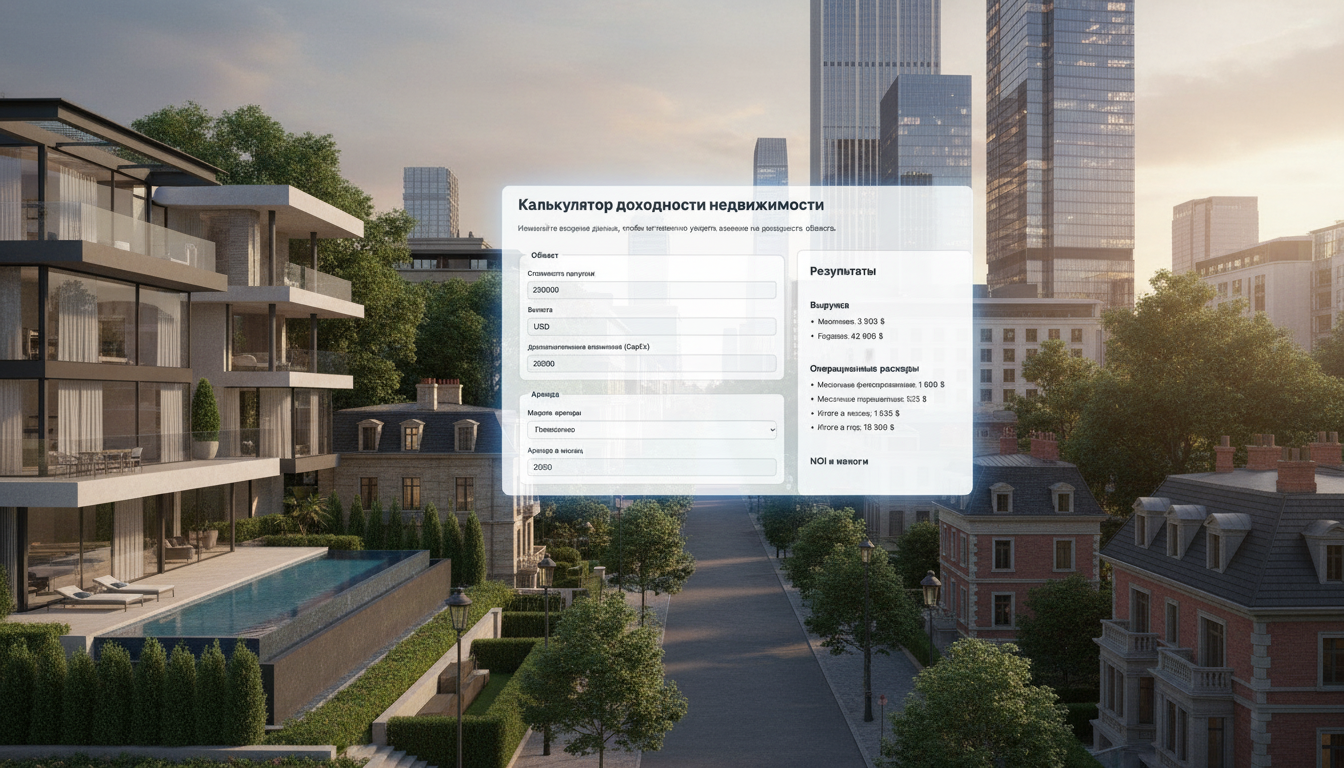

Understanding the Economics Is More Important Than Promises of Returns

Before making an investment decision, it is important to understand not only the potential income but also the expense structure, occupancy scenarios, and payback period.

For this purpose, we use an investment calculator that allows you to evaluate the project's economics based on input parameters.

For this purpose, we use an investment calculator that allows you to evaluate the project's economics based on input parameters.

The calculation includes:

- operating expenses,

- taxes and fees,

- property management,

- vacancy periods,

- maintenance and ongoing repairs.

That is why we use an investment calculator to assess profitability, allowing investors to independently calculate the project's economics considering key parameters.

A detailed instruction on how to use it is provided next to the calculator.

👉 Go to the Investment Calculator

A detailed instruction on how to use it is provided next to the calculator.

👉 Go to the Investment Calculator

Summary

A foreigner can safely invest in real estate in Bali by adhering to three conditions:

- the correct legal model,

- accurate economic calculations,

- selection of a reliable project and location.

Understanding these principles is more important than marketing promises of high returns.

As an example of an investment project, consider

Ocean Look in Nusa Dua.

FAQ

What is the difference between HGB and Leasehold?

What is PT PMA and why does an investor need it?

Is it legal to use a nominal owner?

What are the main risks when investing in real estate in Bali?

What profitability is considered realistic?

In which areas of Bali are investments the most sustainable?

Where should an investor start?

(+62) 821-46-32-43-46